|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Chapter 7 Bankruptcy Rules in Florida: A Comprehensive Guide

Filing for Chapter 7 bankruptcy in Florida can be a daunting task. Understanding the rules and procedures is essential for anyone considering this financial relief option.

Eligibility Requirements

To file for Chapter 7 bankruptcy in Florida, you must meet certain eligibility requirements. The primary factor is passing the means test.

The Means Test

The means test is designed to determine if your income is low enough to qualify for Chapter 7. It compares your average monthly income over six months before filing to the median income of a similar household in Florida.

Residency Requirements

To file in Florida, you must have lived in the state for at least 91 days before filing. If you have not lived in Florida for this period, you must file in the state where you previously resided.

The Filing Process

Filing for Chapter 7 bankruptcy involves several steps, including gathering financial documents and completing necessary forms.

Key Documents

- Tax returns

- Income statements

- Debts and asset lists

It is advisable to consult a professional, such as a bankruptcy attorney in Lawrence, KS, for guidance through this process.

Court Proceedings

Once your paperwork is filed, you will need to attend a meeting of creditors. This meeting allows creditors to ask questions about your financial situation.

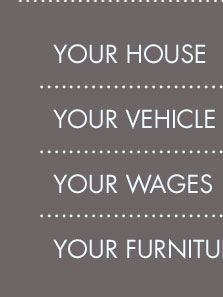

Exemptions in Florida

Florida has specific exemptions that protect certain property from being liquidated during bankruptcy.

Homestead Exemption

One of the most significant exemptions is the homestead exemption, which can protect your primary residence.

Personal Property

Additional exemptions include personal property, retirement accounts, and certain wages.

Frequently Asked Questions

What is the duration of a Chapter 7 bankruptcy process in Florida?

The Chapter 7 process typically takes four to six months from filing to discharge.

Will filing for Chapter 7 affect my credit score?

Yes, it will impact your credit score, but it can also provide a fresh financial start, enabling you to rebuild credit over time.

Can all debts be discharged under Chapter 7?

Not all debts can be discharged. Debts like student loans, child support, and certain taxes are typically non-dischargeable.

For more detailed advice, consider consulting a professional, such as a bankruptcy attorney in Loganville, GA.

If you reside, own a property, or have a place of business in the Florida and are currently burdened by unsecured debts that you can no longer pay, you may be ...

Florida Bankruptcy Income Limits for Chapter 7 Bankruptcy - Payments on Secured Debts - Taxes - Deductions Required by Your Employer - Certain ...

To file a Chapter 7 bankruptcy in Florida, a person must be a permanent Florida resident or own property in the state.

![]()